Remuneration policy for company officers

Remuneration policy for Board members

Overall structure of the remuneration package

The Company’s directors receive remuneration for their service as members of the Board and its committees and for their involvement inthe work carried out by these bodies. The maximum aggregate amount of remuneration paid to Board members was set at €1,600,000by resolution of the shareholders at the Shareholders’ General Meeting of 17 April 2019. This limit applies to the remuneration paid todirectors for one calendar year, regardless of the date of payment. It does not include remuneration paid to executive company officersserving on the Board, who receive remuneration only as provided by the policy mentioned in paragraph 4.1.2 below, nor that paid todirectors representing employees as part of their employment. Remuneration received by directors is paid twice each year in arrears aftersix months of completed service.

The guidelines for the allocation of remuneration paid to directors, as adopted by the Board on 8 February 2023 following proposals from the Remuneration Committee, are as follows:

• At the outset, Board members receive annual fixed remuneration consisting of:

- basic remuneration equal to €26,500 for each Director;

- with additional remuneration of:

- €55,000 for the Lead Director,

- €20,000 for Board committee chairmen,

- €10,000 for Audit Committee members,

- €5,500 for Remuneration Committee members,

- €5,500 for Appointments and Corporate Governance Committee members,

- €4,000 for permanent members of the Strategy and CSR Committee.

- Directors also receive annual variable remuneration equal to:

- €3,500 for each Board meeting during the year at which they are physically present. If more than one Board meeting is held on the same day, this fee is paid only once, with the exception of the two meetings held before and after the Shareholders’ General Meeting, when directors receive two payments, their amounts depending on the manner of participation in these meetings.

- €1,500 for each meeting of a Board committee during the year at which they are physically present. If a committee holds more than one meeting on the same day, this fee is paid only once.

The €1,500 amount is paid to any director participating on a voluntary basis in person at a meeting of the Strategy and CSR Committee.

- Any director taking part in a meeting of the Board or any of its committees remotely via videoconferencing or audio conferencing is entitled to receive variable remuneration determined as follows:

- The fee per meeting is equal to 100% of the amount to which the director would have been entitled for being physically present at the meeting, up to a maximum of two meetings of the Board and two meetings of the Strategy and CSR Committee.

- The fee per meeting is halved for meetings of the Board and of the Strategy and CSR Committee in excess of the two-meeting limit mentioned above and for all meetings of the other committees.

- Provided they are physically present at meetings of the Board or of any of its committees, additional amounts are paid to directors as follows:

- €1,000 per meeting for directors who reside elsewhere in Europe,

- €6,000 per meeting for directors who reside outside Europe.

If the Board or any of its committees holds more than one meeting on the same day, this additional amount is paid only once.

Directors are entitled to the reimbursement of expenses they have incurred in the exercise of their duties and, in particular, any travel and accommodation costs connected with attending meetings of the Board and its committees.

Items of remuneration subject to shareholder approval in accordance with Article L.22-10-8 II of the FrenchCommercial Code

At the Shareholders’ General Meeting of 9 April 2024, in accordance with the provisions of Article L.22-10-8 II of the French Commercial Code, shareholders will be asked to vote on the remuneration policy for Board members, as presented above.

Remuneration policy for executive company officers, and specifically for Xavier Huillard, Chairman and Chief Executive Officer

Overall structure of the remuneration package

For VINCI SA’s executive company officers, the Board has approved a remuneration policy including a short-term fixed component, a shortterm variable component and a long-term variable component. Currently, Xavier Huillard is VINCI’s only executive company officer. All three components of this remuneration policy are discussed below.

| GENERAL REMUNERATION POLICY FOR EXECUTIVE COMPANY OFFICERS | POLICY APPLICABLE TO XAVIER HUILLARD | |||||||

| Item of annual remuneration | Type of payment | Maximum amount (in € thousands) | Upper limit | Performance conditions | Performance indicators | Weight given to indicator in the corresponding bonus | Amount | Application of policy for 2024 |

|---|---|---|---|---|---|---|---|---|

| Short-term fixed component (§ 4.1.2.2) | Paid in cash in the current calendar year in 12 monthly instalments | Set by the Board | Not applicable | No | Not applicable | Not applicable | €1,300,000 (Set in April 2022) | €1,300,000 |

| Short-term variable component (§ 4.1.2.3) | Paid in cash in the calendar year following its approval at the Shareholders General Meeting | Ranging from nil to the upper limit of the short-term variable component | Up to 160% of the fixed component, determined by the Board | Yes | Upper limit | Breakdown of upper limit | ||

| Earnings per share attributable to owners of the parent | 50% to 60% Limit corresponding to one-third for each indicator | €2,080,000 (160% of the fixed component) | 60% | |||||

| Recurring operating income | ||||||||

| Operating cash flow | ||||||||

| Managerial performance indicators | 15% to 20% | 15% | ||||||

| ESG performance indicators | 25% to 30% | 25% | ||||||

| Total short-term variable component | 100% | 100% | ||||||

| Long-term variable component (§ 4.1.2.4) | Award of VINCI shares or units that vest after three years, subject to continued service | Number of shares or units set by the Board | 100% of the upper limit for short-term remuneration (fixed and variable) | Yes | Upper limit | Weighting for 2024 | ||

| Economic criteria | 50 % à 65 % | Number of shares set by the Board, corresponding to a maximum fair value (under IFRS 2) of €3,380,000 | 50% | |||||

| Financial criteria | 15% to 25% | 25% | ||||||

| ESG criteria | 15% to 25% | 25 % | ||||||

| Total long-term variable component | 100% | 100 % | ||||||

Short-term fixed component

The short-term fixed component of an executive company officer’s remuneration is set at an amount determined by the Board at the timeof the officer’s appointment or the renewal of his or her term of office.

At the Board meeting of 3 February 2022, the short-term fixed component of Mr Huillard’s remuneration was set at €1,300,000 per year for the duration of his term of office as Chairman and Chief Executive Officer, with effect from the date of the 2022 Shareholders’ General Meeting, which was held on 12 April 2022. It is paid in 12 monthly instalments.

Short-term variable component

The criteria for determining the short-term variable component aim to take account of the Group’s all-round performance. To this end, they include three distinct elements that relate respectively to economic and financial, managerial, and environmental, social and governance (ESG) factors, which together contribute to VINCI’s all-round performance. The rationale for choosing indicators is given below. The amount of the short-term variable component is equal to the sum of the bonuses thus determined, after applying these criteria. These criteria and their implementation were approved by the Board upon recommendations based on work carried out jointly by the Remuneration Committee and the Appointments and Corporate Governance Committee, in light of the Group’s highly satisfactory economic performance and given the Board’s constant focus on adapting the criteria used to developments in the Group’s businesses and its strategy.

| Type of performance indicator | Indicator | Relevance of indicators and how they are used |

|---|---|---|

| Economic and financial performance indicators | Earnings per share | These three indicators reflect the quality of the Group’s economic and financial management from different complementary angles. A bonus is associated with each performance indicator, the amount of which depends on the percentage change recorded in the corresponding indicator. The bonus amount has a lower limit of €0 (for a negative change of 10% or more) and an upper limit of one-third of the amount corresponding to the upper limit for the overall bonus tied to the economic and financial performance indicators (for a positive change of 10% or more), in accordance with a remuneration schedule set by the Board. In the event that a performance improvement in excess of 10% is noted for one or more indicators, an outperformance bonus limited to 20% for each indicator will be awarded, with the understanding that the total of the three bonuses may not be greater than €1,248,000. That amount represents 60% of the upper limit for the short-term variable component. |

| Recurring operating income | ||

| Operating cash flow (adjusted for investments made in the renewable energy sector) | ||

| Managerial performance indicators | International diversification | This indicator aims to maintain a focus on balancing the Group’s geographic exposure. |

| Management and dialogue with stakeholders | This indicator reflects the Board’s assessment of the extent to which priorities have been met, depending on the issues it feels merit particular attention. | |

| ESG performance indicators | Workforce safety and engagement | The Board considers the following indicators as falling within this category: • the effectiveness of workplace accident prevention policies, which is assessed in particular by tracking the accident frequency rate; • the results of the policy to bring more women into leadership positions as measured by the change in the percentage of women serving on management and executive bodies across the Group; • the development of employee share ownership programmes outside France, given the proportion of staff in other countries who are eligible to enrol in the Group savings plan. |

| Environment | With regard to environmental issues, the Board has selected the following indicators: • reductions in Scope 1 and 2 greenhouse gas emissions • managerial efforts across the Group to reduce the intensity of Scope 3 greenhouse gas emissions | |

| Corporate governance | This indicator tracks the quality of the work carried out with the Appointments and Corporate Governance Committee and the Board on the succession plan for the executive company officer and the related governance measures. |

Given the level of operating cash flow achieved by the Group at the end of 2023, the Board decided that economic and financial performance indicators for 2024 will be evaluated in relation to the annual average of each indicator as noted at 31 December 2022 and 31 December 2023. In addition, the Board decided that these three indicators will be adjusted for the impact of the new levy on long-distance transport infrastructure operators introduced by France’s Finance Law for 2024 (Law 2023-1322 of 29 December 2023).

With respect to managerial performance, the Board will review in particular the balance of the Group’s geographic exposure and the assistance provided by the Chairman and Chief Executive Officer in support of the managerial transition.

With respect to ESG performance, the CDP indicator has been replaced to provide a better fit with the Group’s environmental ambition and the corporate governance indicator has been maintained so as to continue tracking the work relating to the succession plan for the executive company officer and the related governance matters.

The Board and its committees ensure that all-round performance is evaluated by taking into account progress against targets for each ofthe selected performance indicators.

At the start of a given year, the Board sets goals, applying a weighting coefficient to those considered as priorities. The Board reserves the option to modify the indicators in use, whether in relation to their type or how they are applied, when such a move is, in its view, justified by the circumstances, provided that the reasons for these changes are outlined at the Shareholders’ General Meeting in which shareholders are asked to vote on the remuneration policy for the individual concerned. The Board reaches its decisions in conjunction with its examination of the financial statements for the prior year, after reviewing the recommendations of the Remuneration Committee and after having given Board members the opportunity to pursue discussions without any executive company officers being present.

Long-term variable component

The remuneration of executive company officers includes a long-term portion intended to align the interests of the beneficiaries with those of shareholders, taking a multi-year perspective.

To this end, the Board carries out an analysis each year to determine the appropriate structure of the award for this component. It may be comprised of physical or synthetic VINCI shares and may be granted either under a plan set up in accordance with ordinary law or underany other plan permitted by law. Since 2014, all awards to VINCI SA’s executive company officers have been granted in accordance with ordinary law and satisfied using existing VINCI shares (and therefore not in accordance with Article L.225-197-1 of the French CommercialCode due to regulatory constraints).

The fair value measurement for these awards (under IFRS 2) is capped, at the time they are decided by the Board, at 100% of the total of fixed remuneration plus the upper limit of short-term variable remuneration. Vesting of these awards is subject to:

• Performance conditions evaluated over a period of three years. This performance evaluation may lead to a decrease in the number ofshares delivered or eliminate the award entirely.

• Continued service within the Group, as mentioned in the table on the next page. However, the Board reserves the right to maintaineligibility in other cases, depending on its assessment of the circumstances.

The performance conditions applying to plans to be put in place beginning in 2024 are presented in paragraph 5.1, “Policy on the granting of awards”, page 166.

The Board may amend these performance conditions either in the event of a strategic decision that changes the scope of the Group’sbusiness activities or under exceptional circumstances.

Condition of continued service applicable to Xavier Huillard

As Mr Huillard has not entered into an employment contract with the Group, the condition of continued service is evaluated with regardto the appointments he holds at VINCI SA, namely as Chairman, Chief Executive Officer and Director, the terms of office of which arelimited by law and the Articles of Association.

The condition of continued service applicable to Mr Huillard with respect to share awards that have not vested at the time of evaluationis defined as follows:

| Event occurring before the vesting date | Impact on awards not yet vested under each plan |

|---|---|

| Resignation from his positions as Chairman, Chief Executive Officer and Director before his term of office ends | Complete forfeiture of non-vested awards |

| Termination as Chief Executive Officer due to resignation connected with a succession plan, age limit or retirement | Partial eligibility maintained, on a pro rata basis, over the period from the grant date of the award to the date of termination |

| Death or disability | Eligibility maintained, application of specific plan provisions in case of death or disability |

| Dismissal as Chief Executive Officer by decision of the Board | Partial eligibility maintained, on a pro rata basis, over the period from the grant date of the award to the date of termination |

Pension and insurance plans

The remuneration policy for executive company officers includes eligibility for the pension and insurance plans set up by VINCI for itsemployees.

A supplementary defined benefit pension plan (known in France as an “Article 39” plan) was set up in 2010 by the Company for seniorexecutives of VINCI SA and its subsidiary VINCI Management, which is described in paragraph 4.2.3, “Supplementary pension plan set up for senior executives”, page 164. This plan was closed to new members in 2019 pursuant to Order 2019-697 of 3 July 2019, but itsbeneficiaries are not required to forfeit any benefits obtained at the closing date.

Mr Huillard is a beneficiary of this pension plan, as resolutions to this effect were passed at the Shareholders’ General Meetings of 6 May 2010, 15 April 2014 and 17 April 2018. Since 2019, he has been covered by the upper limit on benefits under this plan, which is eight times the annual French social security ceiling; he cannot receive any additional benefits.

Under this plan, at the settlement of his benefits provided by the general social security plan, Mr Huillard will receive a supplementary pension, the amount of which is capped at eight times the annual French social security ceiling (i.e. €351,936 at 31 December 2023).

Given that the Board has officially confirmed his senior executive status, Mr Huillard is also eligible to participate in the defined contribution pension plans and insurance plans set up by VINCI for its employees.

It should be noted that the benefits under these plans were taken into account in determining his overall remuneration.

The Board reserves the right, as necessary, to put in place a substitute plan in the event that a new executive company officer takes up his or her position without being eligible for coverage under the aforementioned plans.

Benefits in kind

The executive company officer has the use of a company car.

Overview of the remuneration policy

On the basis of the above structure, this remuneration policy has the following features:

| It is balanced. | It achieves a balance between: • short- and long-term components, which ensures it is aligned with shareholder interests; • economic and financial performance and the implementation of sustainable development policies. |

|---|---|

| It is capped. | Each of its elements has an upper limit: • the fixed component is stable for the entire term of office, • the short-term variable component is capped, • the long-term variable component is capped (fair value under IFRS 2) when it is initially granted. |

| It is subject, for the most part, to demanding performance conditions. | Future performance is assessed in relation to past performance. |

| It is in the interests of the Company. | Its amount is moderate, given the VINCI Group’s size and complexity. The performance conditions selected by the Board encourage Executive Management to consider not only short-term, but also long-term, and even very long-term, objectives. |

| It helps ensure the continuity of the Company and is in keeping with its business strategy. | The VINCI Group has a business model based on a complementary set of activities conducted over both short and long time frames. These businesses can only prosper over the long term if they are geographically diversified and respect stakeholders and the environment where they are pursued. The remuneration system aptly reflects these imperatives. |

Items of remuneration subject to shareholder approval in accordance with Article L.22-10-8 II of the French Commercial Code

At the Shareholders’ General Meeting of 9 April 2024, in accordance with Article L.22-10-8 II of the French Commercial Code, shareholders will be asked to vote on the remuneration policy for executive company officers, and in particular that applicable to Xavier Huillard, Chairman and Chief Executive Officer, as presented above.

Comparative information

External benchmarking exercise

At the request of the Remuneration Committee, a benchmarking exercise relating to the components of the Chairman and Chief ExecutiveOfficer’s remuneration package is conducted by an independent firm and updated on a regular basis. The aim of this exercise is to ensurethat the remuneration of the Group’s top executive remains coherent and in line with market practice. The most recent update was basedon the latest publicly available information relating to the 2022 financial year.

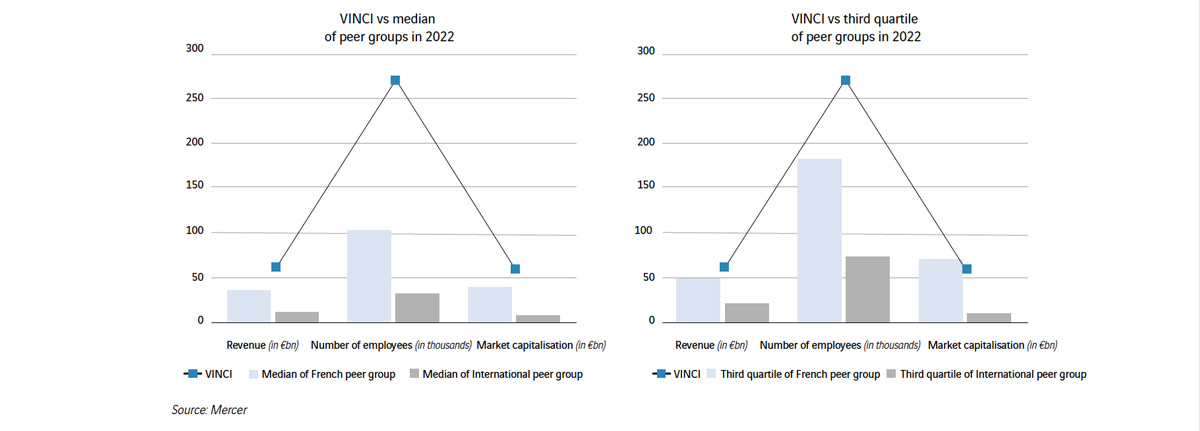

For the purposes of this exercise, the Remuneration Committee selected two representative peer groups, the first comprised of Frenchindustrial companies that are members of the CAC 40 (the “French peer group”), and the second comprised of European companies withoperations in the construction sector or infrastructure concessions (the “International peer group”).

These two peer groups are as follows:

| French peer group | Air Liquide, Alstom, Bouygues, Danone, Engie, EssilorLuxottica, Legrand, L’Or.al, Michelin, Pernod Ricard, Renault, Safran, Saint-Gobain, Schneider Electric, Stellantis, TotalEnergies, Veolia |

|---|---|

| International peer group | A.roports de Paris, Bouygues, Eiffage, Fraport, Hochtief, Strabag, ACS, Ferrovial, Skanska, Mundys (formerly Atlantia), Webuild, Atlas Arteria |

The charts below situate VINCI in relation to the median and the third quartile of each of these peer groups and show that VINCI is positioned above the peer groups in terms of revenue, number of employees and market capitalisation.

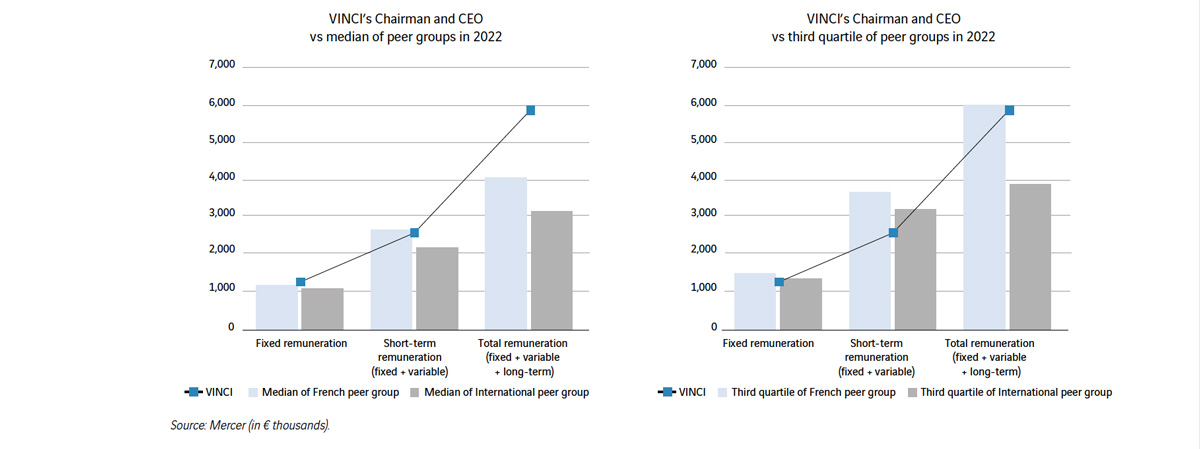

According to the results of the benchmarking exercise for 2022, the total remuneration received by VINCI’s Chairman and Chief ExecutiveOfficer can be characterised mainly as follows:

• The fixed component is near the median and third quartile of both peer groups.

• The short-term component (fixed and variable) is near the median of the French peer group but above the median of the International peer group.

• The total remuneration (fixed + variable + long-term) is above the median of both panels but near the third quartile of the French peer group.

Internal comparison

In accordance with the sixth paragraph of Article L.22-10-9 I of the French Commercial Code, it is noted that the ratio between the Chairman and Chief Executive Officer’s total annual remuneration (fixed, variable and long-term components) and

• the average full-time equivalent remuneration(*) for 2023 of VINCI SA’s employees, not including company officers, employed from 1 January to 31 December (Ratio A) is equal to 46.5;

• the median full-time equivalent remuneration(*) for 2023 of VINCI SA’s employees, not including company officers, employed from 1 January to 31 December (Ratio B) is equal to 82.6; • the average full-time equivalent remuneration (*) for 2023 of the employees based in France of French companies over which VINCI has exclusive control within the meaning of Article L.233-16 II of the Commercial Code, not including VINCI SA’s executive company officers, employed from 1 January to 31 December (Ratio C) is equal to 133.4.

The indicators mentioned in Article L.22-10-9 recorded the movements shown in the table below:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|

| Change from the prior year in the Chairman and Chief Executive Officer’s remuneration | + 8.8%(**) | + 0.54%(**) | -9.2%(**) | +27.9%(**) | +14.2%(**) |

| Change from the prior year in net income attributable to owners of the parent | + 9,3 % | - 61,9 % | +109.3% | +64% | +10.4% |

| Change from the prior year in the average remuneration(*) of the Company’s employees | +5.0% | -4.1% | +4.4% | +9.9% | +8.1% |

| Change from the prior year in the average remuneration(*) of the employees in France of companies over which VINCI has exclusive control | +1.2% | -4.7% | +3.9% | +3.1% | +5.1% |

| Annual change in Ratio A | +3.7% | +4.6% | -13.1% | +16.5% | +6.2% |

| Annual change in Ratio B | +5.1% | -6.0% | -8.4% | +17.1% | +11% |

| Annual change in Ratio C | +7.6% | +5.4% | -12.5% | +24.2% | +9.3% |

(*) Remuneration amount including fixed and variable components, the employer contribution, long-term incentive payments, the fair value of performance share awards and benefits in kind.

(**) Remuneration amount including the fixed component paid in year Y, the short-term variable component in respect of year Y−1 paid in year Y, the IFRS 2 fair value of the share award granted in year Y as the long-term component of remuneration, benefits in kind and remuneration as a Board member paid in year Y.

Remuneration paid in 2023 or due in respect of this same year to company officers

Decisions relating to the Chairman and Chief Executive Officer’s remuneration

Short-term variable remuneration due in respect of 2023 to the Chairman and Chief Executive OfficerAt its meeting of 7 February 2024, the Board, acting on a proposal from the Remuneration Committee and, for the managerial and ESG parts, on a proposal prepared jointly by this committee and the Appointments and Corporate Governance Committee, approved as shown below the short-term variable remuneration payable to Mr Huillard in respect of 2023.

Economic part

The following movements were recorded for the indicators relating to economic and financial performance in 2023:

| Indicator | 2023 | 2022 | 2023/2022 change | 2023 bonus (in €) | Upper limit applicable in 2023 |

|---|---|---|---|---|---|

| Earnings per share attributable to owners of the parent (in €) | 8.18 | 7,47 | + 9,5 % | 408,551 | €416,000 potentially raised to €499,200(**) |

| Recurring operating income (in € millions) | 8,175 | 6,481 | +26.1% | 483 127 | €416,000 potentially raised to €499,200(**) |

| Operating cash flow(*) (in € millions) | 8,176 | 6,649 | +23.0% | 470,147 | €416,000 potentially raised to €499,200(**) |

| Capping effect | -113,826 | ||||

| Total economic and financial part | €1,248,000 | €1,248,000 |

(*) Excluding investments in renewable energy.

(**) After applying the outperformance rule mentioned in paragraph 4.1.2.3.

The Group’s performance showed improvement between 2022 and 2023 for each of the three indicators. The economic and financial partreached the upper limit provided for by the remuneration policy after the capping effect.

Part based on managerial and ESG performance

At its meeting of 7 February 2024, the Board approved the recommendations of the Remuneration Committee and the Appointments andCorporate Governance Committee, which had examined managerial and ESG performance in detail.

The Board took into account the following elements:

| Indicator or indicator category | Performance relative to prior year | Factors taken into account |

|---|---|---|

| Managerial performance | 100% | This indicator aimed to reflect the level of geographic diversification of the Group’s business activities. The Board took note of the Group’s strong revenue growth outside France as well as the increase in the relative contribution of the Group’s international activities (57%), in line with the targets set at the start of the year. In addition, the Board observed that the high quality of the Chief Executive Officer’s dialogue with all stakeholders had been maintained. |

| Environment | 58% | For this category, the Board had selected as indicators the maintenance of the A score received by VINCI from CDP and reductions in greenhouse gas emissions, as well as any other indicator that could be used to measure the Group’s contribution to preserving natural environments and promoting the circular economy. The Board noted that the CDP score declined from A to A− in 2023, due to the introduction of more stringent requirements and the fact that actual progress against emissions reduction targets fell short of planned progress, despite the efforts brought to bear by the Group. |

| Workforce safety and engagement | 98.2% | For this category the Board had selected as indicators (i) the effectiveness of workplace accident prevention policies, assessed in particular by tracking the accident frequency rate; (ii) the results of the policy to bring more women into leadership roles as measured by the percentage of women serving on management and executive bodies; and (iii) the development of employee share ownership programmes outside France. The Board commended the decline in the workplace accident frequency rate, although the target has not yet been met. In addition, the Board noted an improvement in female representation in leadership roles as well as an increase in the percentage of employees outside France who are eligible to enrol in the Group savings plan. |

| Corporate governance | 100% | This indicator was used to track the quality of interactions with the Appointments and Corporate Governance Committee and with the Lead Director. The Board is satisfied with the progress made in preparing the succession process and with the various milestones achieved during the year. |

These achievements led the Board to set the performance-based remuneration for these criteria as follows:

| Indicator (in €) | 2022 bonus | Percentage of maximum bonus received in 2022 | 2023 Bonus | Upper limit applicable in 2023 | Percentage of maximum bonus received in 2023 |

|---|---|---|---|---|---|

| Managerial performance | 312,000 | 100% | 312,000 | 312,000 | 100% |

| ESG performance | 447,200 | 86% | 438,006 | 520,000 | 84.2% |

| Variable remuneration based on managerial and ESG performance | 759,200 | 91% | 750.006 | 832,000 | 90.1% |

Total short-term variable remuneration for 2023

| Indicator (in €) | 2022 | 2023 | 2023 vs 2022 | Upper limit applicable in 2023 | Percentage of maximum bonus received in 2023 |

|---|---|---|---|---|---|

| Total economic part | 1,248,000 | 1,248,000 | 100%% | 1,248,000 | 100% |

| Part based on managerial and ESG performance | 759.200 | 750,006 | 98.8% | 832,000 | 90.1% |

| Total variable remuneration | 2,007,200 | 1,998,006 | 99.5% | 2,080,000 | 96.1% |

Long-term component of the Chairman and Chief Executive Officer’s remuneration

At its meeting of 13 April 2023, the Board decided to grant a conditional award of VINCI shares to Mr Huillard, corresponding to a total fair value (under IFRS 2) of €3,380,000, in consideration of the upper limit stipulated for such an award in the remuneration policy applicable to him. As the fair value of VINCI was calculated by an independent valuer at €92.89 per share, the Chairman and Chief Executive Officer was granted an award, in accordance with ordinary law, of 36,387 existing VINCI shares that will vest at the end of a three-year period on 13 April 2026, subject to continued service as well as applicable performance conditions that will be evaluated at 31 December 2025 as described in paragraph 5.3.2, “Long-term incentive plan for the Chairman and Chief Executive Officer set up by the Board on 13 April 2023”, page 170.

Long-term incentive plans for which Mr Huillard is eligible

Plans set up on 8 April 2021, 12 April 2022 and 13 April 2023

These plans are mentioned in paragraph 5.3.1, “Existing long-term incentive plans”, pages 169 and 170.

Mr Huillard is eligible to be granted conditional awards under the following long-term incentive plans remaining in force at 31 December 2023:

| Number of shares | Fair value at the grant date(in €) | Percentage of the year’s total remuneration | Vesting date | |

|---|---|---|---|---|

| Plan set up on 8 April 2021 | 30,900 | 2,429,976 | 44% | 08/04/2024 |

| Plan set up on 12 April 2022 | 35,000 | 2,689,750 | 45.1% | 12/04/2025 |

| Plan set up on 13 April 2023(*) | 36,387 | 3,379,988 | 50.6% | 13/04/2026 |

(*) Subject to the approval by shareholders of the resolution relating to remuneration paid or granted to Mr Huillard at the Shareholders’ General Meeting of 9 April 2024.

In accordance with the provisions of Article 26.3.3 of the Afep-Medef code, Mr Huillard made a commitment not to engage in any hedgingtransactions in respect of his own risks with regard to the shares granted under the long-term incentive plans for which he is eligible,and agreed to respect this commitment until the end of the holding period for the shares as set by the Board, where applicable.

Pension and insurance plans

Since 2022, Mr Huillard has met all eligibility requirements to claim his pension under the defined benefit plan set up in March 2010 bythe Company for its senior executives, namely having reached the legal retirement age, having completed at least 10 years’ service asspecified by the plan and having ended his professional career within the Group as stipulated by the Board in March 2010 for companyofficers not holding employment contracts.

The pension benefits Mr Huillard would be entitled to receive at 31 December 2023 are subject to a payment limit equal to eight timesthe annual French social security ceiling, as provided for all beneficiaries under this plan.

With respect to the defined benefit pension plan mentioned in paragraph 4.1.2.5, “Pension and insurance plans”, page 159, and as requiredby Decree 2016-182 of 23 February 2016, the following points should be noted:

| Estimated amount of future pension payments at 31 December 2023 | Company’s obligation at 31 December 2023(*) |

|---|---|

| €351,936 per year, equivalent to 10.63% of the short-term fixed and variableremuneration received by Mr Huillard in 2023(*). | VINCI’s obligation in respect of the supplementary pension plan for Mr Huillard mentioned in paragraph 4.1.2.5, “Pension and insurance plans”, page 159, amounted to €7.5 million, including tax and social charges. |

(*) Retirement benefit obligations are also described in the Notes to the consolidated financial statements beginning on page 368.

Employment contract, specific pension plans, severance pay and non-competition clause

| Executive company officer | Employment contract | Supplementary pension plan | Allowances or benefits that could be due as a result of the cessation of duties or a change in duties | Allowances for non-competition clause |

|---|---|---|---|---|

| Xavier Huillard, Chairman and Chief Executive Officer | No | Yes | No | No |

Chairman and Chief Executive Officer’s remuneration

Summary of remuneration awarded and share awards granted (in €)

| Xavier Huillard | 2023 | 2022 |

|---|---|---|

| Remuneration due in respect of the year | 3,303,580 | 3,284,718 |

| Value of awards under the long-term incentive plan set up on 12 April 2022 | 2,689,750 | |

| Value of awards under the long-term incentive plan set up on 13 April 2023 | 3,379,988 | - |

| Total | 6,683,568 | 5,974,468 |

Summary of remuneration (in €)

| 2023 | 2022 | |||

| M. Xavier Huillard | Amount due for the year as decided by the Board | Amount paid during the year by the Company | Amount due for the year as decided by the Board | Amount paid during the year by the Company |

|---|---|---|---|---|

| Gross fixed remuneration(1) | 1,300,000 | 1,296,944(4) | 1,271,944 | 1,275,000(4) |

| Total gross short-term variable remuneration | 1,998,006 | - | 2,007,200 | - |

| Of which: | ||||

| – Gross short-term variable remuneration | 1,984,176 | 1,993,370 | 1,993,370 | strong>1,848,650 |

| Remuneration as a Board member(2) | 13,830 | 13,830 | 50,000(4) | |

| Benefits in kind (3) | 5,574 | 5,574 | 5,196 | 5,196 |

| Total | 3,303,580 | 3,309,718 | 3,284,718 | 3,143,054 |

(1) See paragraph 4.1.2.2, “Short-term fixed component”, page 156.

(2) In 2022 and 2023, Mr Huillard received remuneration as a Board member from a foreign subsidiary of VINCI. These amounts are considered as included in the total remuneration for the year as decided by the Board, acting on a proposal from the Remuneration Committee. Consequently, they are deducted from the amount of the total gross short-term variable remuneration payable to him in respect of the year during which this remuneration as a Board member was paid. Mr Huillard does not receive remuneration as a Board member from VINCI SA.

(3) Mr Huillard had the use of a company car in 2022 and 2023.

(4) A €3,056 adjustment was made to the payment received in the month of January 2023.

Items of remuneration paid in 2023 or due in respect of this same year to the executive company officer, subject toapproval at the Shareholders’ General Meeting of 9 April 2024

At the Shareholders’ General Meeting of 9 April 2024, in accordance with Article L.22-10-34 II of the French Commercial Code, shareholders will be asked to vote on a draft resolution relating to the items of remuneration paid in 2023 or due in respect of this same year to Mr Huillard, Chairman and Chief Executive Officer.

| Xavier Huillard | ||

|---|---|---|

| Item of remuneration | Amount | Observations |

| Fixed remuneration | €1,300,000 | Annual gross fixed remuneration in respect of the 2023 financial year set at €1,300,000 by the Board at its meeting of 3 February 2022 for the duration of the term of office beginning in April 2022. |

| Variable remuneration | €1,998,006 | Gross variable remuneration in respect of the 2023 financial year, as approved by the Board at its meeting of 7 February 2024, as explained in paragraph 4.2.1.1, “Overall structure of the remuneration package”, page 161, which is payable in 2024. |

| Annual deferred variable remuneration | n/a | Not applicable. |

| Multi-year variable remuneration | n/a | Not applicable. |

| Long-term incentive plan set up in 2023 | €3,379,988 | At its meeting of 13 April 2023, the Board granted a conditional award of VINCI shares to Mr Huillard, corresponding to a total fair value (under IFRS 2) of €3,380,000. As the fair value of VINCI was calculated by an independent valuer at €92.89 per share, Mr Huillard was granted an award of 36,387 existing VINCI shares that will vest at the end of a three-year period on 13 April 2026, subject to continued service as well as the performance conditions described in paragraph 5.3.2, “Long-term incentive plan for the Chairman and Chief Executive Officer set up by the Board on 13 April 2023”, page 170. |

| Remuneration as a Board member | €13,830 | Mr Huillard does not receive remuneration as a Board member from VINCI SA, but he has received remuneration as a Board member from a foreign subsidiary, the amount of which will be deducted from the variable portion of his remuneration. |

| Exceptional remuneration | n/a | Not applicable. |

| Benefits in kind | €5,574 | Mr Huillard has the use of a company car. |

Commitments having previously required the approval of shareholders at the Shareholders’ General Meeting

| Amount | Observations | |

| Severance pay | n/a | Not applicable. |

|---|---|---|

| Non-competition payment | n/a | Not applicable. |

| Supplementary pension plan | No payment | Mr Huillard is eligible for coverage under the supplementary defined benefit pension plan (known in France as an “Article 39” plan) set up at the Company and which has been closed to new members since July 2019, under the same conditions as those applicable to the category of employees to which he is deemed to belong for the determination of employee benefits and other ancillary items of remuneration. Mr Huillard is also eligible for coverage under the mandatory defined contribution pension plan set up by the Company for its executives and other management-level personnel. |

Supplementary pension plan set up for senior executives

VINCI SA and its subsidiary VINCI Management have set up a defined benefit pension plan for their senior executives, with the aim ofguaranteeing them a supplementary annual pension. This plan, now closed to new members due to new regulatory provisions, has thefollowing main features:

| Type of disclosure required by Decree 2016-182 of 23 February 2016 | Information |

|---|---|

| Name of the obligation | Defined benefit pension plan set up on 1 January 2010 and closed to new members from 4 July 2019 |

| Applicable legal provisions | Article 39 of the French Tax Code |

| Eligibility requirements for beneficiaries | At least 10 years’ service within the Group |

| Beneficiaries | Employees of VINCI or VINCI Management having the status of senior executive (“cadre dirigeant”) as defined by Article L.3111-2 of the French Labour Code |

| Conditions for receiving pension payments | - Career within the Group has ended - At least 10 years’ service within the Group - No further payments are due under the mandatory and supplementary pension plans - Aged 67 or older, with the option to receive early benefits, at a reduced level, from the age of 62 |

| Method for determining the remuneration reference amount | Monthly average of the gross fixed and variable remuneration received over the last 36 months of activity multiplied by 12 |

| Vesting formula | The beneficiary’s gross pension is determined using the following formula: Gross pension = 20% R1 + 25% R2 + 30% R3 + 35% R4 + 40% R5, where: R1 = remuneration reference amount between 0 and 8 times the annual French social security ceiling; R2 = remuneration reference amount between 8 and 12 times this ceiling; R3 = remuneration reference amount between 12 and 16 times this ceiling; R4 = remuneration reference amount between 16 and 20 times this ceiling; R5 = remuneration reference amount greater than 20 times this ceiling (all ranges in the formula are inclusive). The remuneration reference amount taken into account for the calculation of the pension will be equal to the gross average monthly remuneration (fixed component + bonuses), including paid leave, received by the beneficiary over the last 36 months multiplied by 12. The limit for this gross pension is 8 times the annual French social security ceiling. |

| Pension payment limit | The pension payment limit is 8 times the annual French social security ceiling. |

| Funding of benefits | The Group uses an insurance contract to externalise its pension plan, to which VINCI and VINCI Management make contributions. |

Remuneration due and/or paid to non-executive company officers in 2023

The total amount of remuneration paid in 2023 by the Company to non-executive company officers as Board members (for the second half of 2022 and the first half of 2023) was €1,188,925.

The total amount of remuneration payable by VINCI to non-executive company officers as Board members in respect of the 2023 financialyear is €1,154,925.

The table below summarises the remuneration received by VINCI’s non-executive company officers as Board members, as well as theother remuneration they received, in 2022 and 2023.

Remuneration paid to non-executive company officers (in €)

| Amount due in respect of 2023 | Amount paid in 2023 | Amount due in respect of 2022 | Amount paid in 2022 | |||||

| By VINCI | By companies consolidated by VINCI | By VINCI (5) | By companies consolidated by VINCI | By VINCI | By companies consolidated by VINCI | By VINCI | By companies consolidated by VINCI | |

| Directors in office | ||||||||

|---|---|---|---|---|---|---|---|---|

| Carlos F. Aguilar | 75,406 | - | 29,406 | - | - | - | - | - |

| Yannick Assouad | 149,533 | - | 135,533 | - | 129,000 | - | 134,000 | - |

| Abdullah Hamad Al-Attiyah | 52,577 | - | 59,327 | - | 67 500 | - | 69,500 | - |

| Benoit Bazin | 92,577 | - | 95,327 | - | 95,970 | - | 80,220 | - |

| Graziella Gavezotti | 79,827 | - | 83,827 | - | 84,783 | - | 85,033 | - |

| Caroline Grégoire Sainte Marie | 76,897 | - | 72,147 | - | 71,000 | - | 71,000 | - |

| Claude Laruelle | 87,077 | - | 90,577 | - | 90,500 | - | 92,500 | - |

| Marie-Christine Lombard | 91,827 | - | 90,327 | - | 90,500 | - | 92,500 | - |

| René Medori | 113,527 | - | 111,527 | - | 111,000 | - | 110,500 | - |

| Annette Messemer | 54,906 | - | 20,556 | - | - | - | - | - |

| Roberto Migliardi1> | 72 577 | - | 69 027 | - | 69 500 | - | 71 000 | - |

| Dominique Muller(1) | 72,027 | - | 69,027/td> | - | 69,500 | - | 71,000 | - |

| Alain Saïd(1) | 66,577 | - | 69,327 | - | 52,909 | - | 19,909 | - |

| Anciens administrateurs | ||||||||

| Robert Castaigne | 26,023 | - | 70,773 | - | 93,000 | - | 89,500 | - |

| Uwe Chlebos(1) | - | - | - | - | 17,671 | 4,167 | 47,171 | 4,167 |

| Ana Paula Pessoas(1) | 20,751 | - | 55,751 | - | 79,000 | - | 81,000 | - |

| Yves-Thibault de Silguy | - | - | - | - | 46,953 | - | 127,203 | - |

| Pascale Sourisse | 22,816 | - | 60,066 | - | 77,500 | - | 74,000 | - |

| Total rémunérations au titre des fonctions d’administrateur et autres rémunérations | 1,154,925 | - | 1,188,925 | - | 1,205,976 | 4,167 | 1,196,726 | 4,167 |

NB: Amounts are before taxes and withholdings in accordance with applicable legislation.

(*) The salaries received by Ms Muller, Director representing employee shareholders, as well as those received by Mr Migliardi, Mr Saïd and Mr Chlebos, Directors representing employees, are not included in the table above.

VINCI shares held by company officers

Shares held by Board members

In accordance with the Company’s Articles of Association, each Board member (other than the Director representing employee shareholders and the Directors representing employees) must hold a minimum of 1,000 VINCI shares which, on the basis of the share price at 29 December 2023 (€113.70), amounts to a minimum of €113,700 invested in VINCI shares.

The number of shares held by each of the company officers, as declared to the Company, is included in the information presented inparagraph 3.2, “Company officers’ appointments and other positions held”, pages 140 to 146.

Share transactions by company officers, executives and persons referred to in Article L.621-18-2 of the French Monetary and Financial Code

In 2023, the Group’s company officers and executives subject to spontaneous declaration of their share transactions carried out thefollowing transactions:

| (in number of shares) | Acquisitions(*) | Disposal (**) |

|---|---|---|

| Xavier Huillard, Chairman and Chief Executive Officer | - | 34,052 |

| Pierre Coppey, Executive Vice-President | - | 9,334 |

| Christian Labeyrie, Executive Vice-President and Chief Financial Officer | - | 107,398 |

| Carlos F. Aguilar, Director | 1,000 | - |

| Annette Messemer, Director | 1,000 | - |

| Qatar Holding LLC, Director (permanent representative: Abdullah Hamad Al Attiyah) | - | 3,030,000 |

(*)Excluding grants of performance share awards and excluding subscriptions for units in company savings funds invested in VINCI shares.

(**)Excluding donations and disposals of units in company savings funds invested in VINCI shares.

Further information

Statement relating to severance pay commitment decided by the VINCI Board of Directors on 7 February 2018 47 Kb

Deliberation of the Board of Directors of 7 February 2018 regarding the satisfaction of performance conditions under the long-term incentive plan set up on 14 April 2015 46 Kb

Archivs

Décision du 6 mai 2010 (engagement de retraite - M. de Silguy) Available in french only 42 Kb

Décision du 3 mars 2010 (rémunération mandataires sociaux) Available in french only 94 Kb

Décision du 27 février 2008 (engagement de retraite - M. de Silguy) Available in french only 57 Kb

VINCI adopts the AFEP-MEDEF code of corporate governance (13 November 2008) 31 Kb

VINCI adopts and implements the AFEP-MEDEF code of corporate governance (16 December 2008) 24 Kb