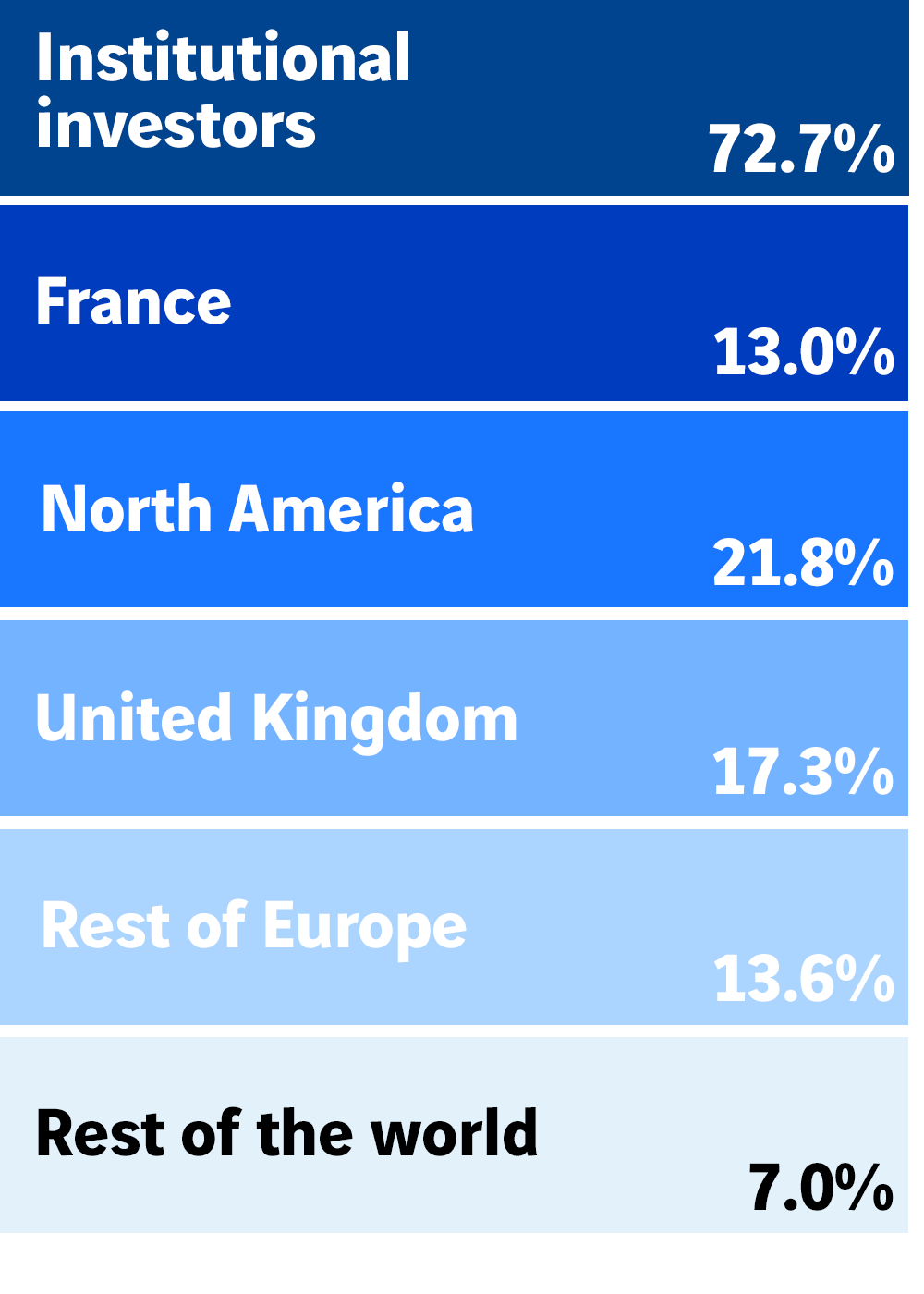

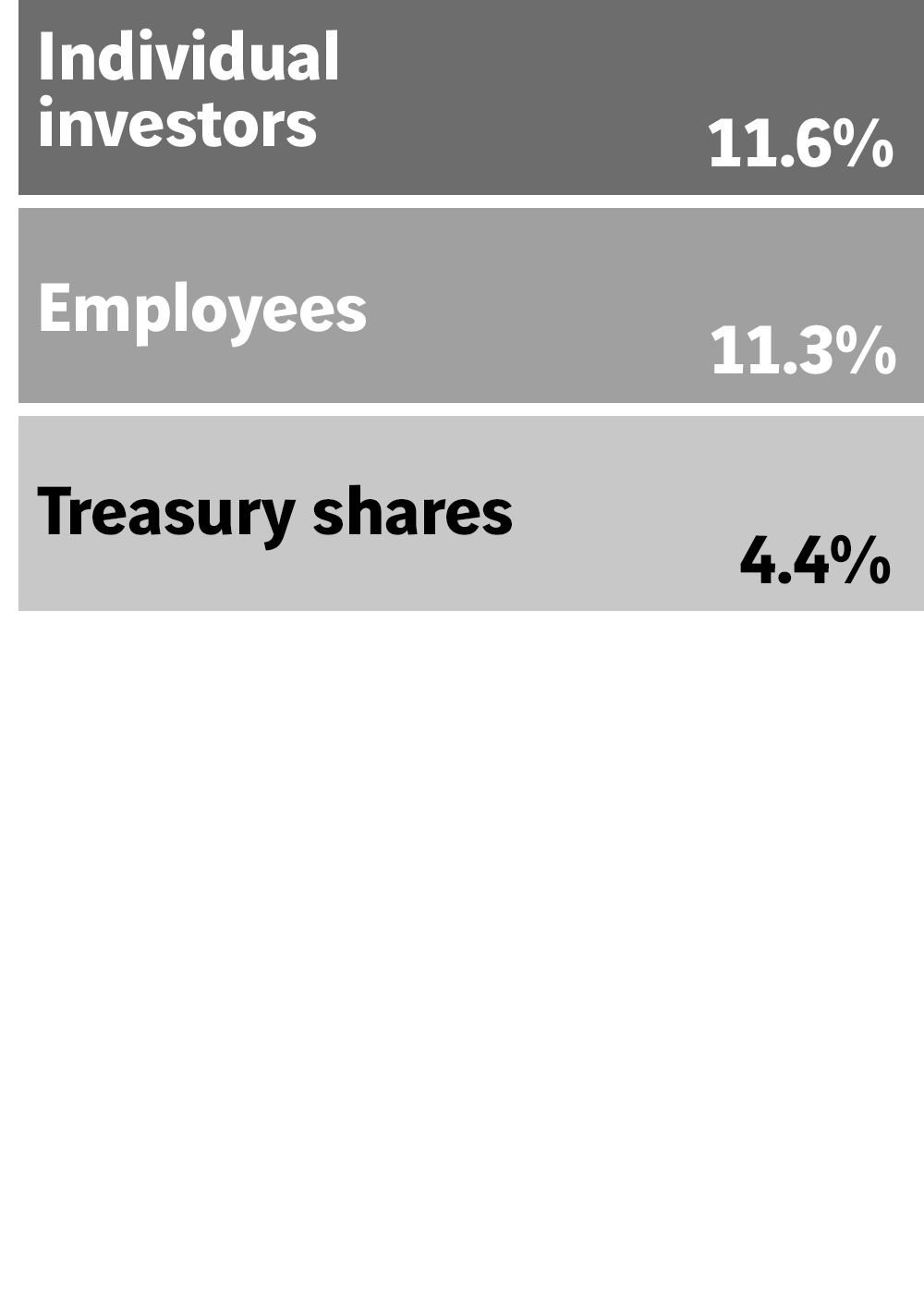

Shareholding

Breakdown of share capital at 31 december 2025

as a percentage of capital

Shareholding structure

581.8 m shares

Almost 1,000 institutional investors

Over 176,000 Group employees and former employees are shareholders, including approximately 46,000 outside France

Movements in share capital over five years

At 31 December 2025, VINCI’s share capital amounted to €1,454,542,075 represented by 581,816,830 shares, each with a nominal value of €2.50, fully paid-up and all of the same class. VINCI shares are registered or bearer shares, at the shareholder’s choice, and may betraded freely.

| Capital increase/(reduction)(in euros) | Share premium arising on contributions or mergers (in euros) | Number of shares issued or cancelled | Number of shares outstanding | Share capital (in euros) | |

|---|---|---|---|---|---|

| Position at 31/12/2020 |

|

|

|

588,519,218 |

1,471,298,045 |

| Group Savings Scheme |

24,607,895 |

714,503,451 |

9,843,158 |

598,362,376 |

1,495,905,940 |

| Cancellation of shares |

(15,000,000) |

- |

(6,000,000) |

592,362,376 |

1,495,905,940 |

| Position at 31/12/2021 |

|

|

|

592,362,376 |

1,480,905,940 |

| Group Savings Scheme |

14,062,385 |

476,715,186 |

5,624,954 |

597,987,330 |

1,494,968,325 |

| Cancellation of shares |

(21,500,000) |

- |

(8,600,000) |

589,387,330 |

1,473,468,325 |

| Position at 31/12/2022 |

|

|

|

589,387,330 |

1,473,468,325 |

| Group Savings Scheme |

20,903,293 |

688,403,371 |

8,361,317 |

597,748,647 |

1,494,371,618 |

| Cancellation of shares |

(21,750,000) |

- |

(8,700,000) |

589,048,647 |

1,472,621,618 |

| Position at 31/12/2023 |

589,048,647 |

1,472,621,618 |

|||

| Group Savings Scheme |

16,428,413 |

651,916,705 |

6,571,365 |

595,620,012 |

1,489,050,030 |

| Cancellation of shares |

(34,507 ,955) |

- |

(13,803,182) |

581,816,830 |

1,454,542,075 |

| Position at 31/12/2024 |

581,816,830 |

1,454,542,075 |

|||

| Group Savings Scheme |

18,679,533 |

752,113,764 |

7,471,813 |

589,288,643 |

1,473,221,608 |

| Cancellation of shares |

(18,679,533) |

- |

(7,471,813) |

581,816,830 |

1,454,542,075 |

| Position at 31/12/2025 |

581,816,830 |

1,454,542,075 |

Crossing shareholding thresolds

Legal and regulatory provisions

Under the terms of Article L. 223-7 of France’s Commercial Code, when the shares of a company whose registered office is in France are admitted to trading on a regulated market, any person or legal entity acting alone or jointly with others who comes to own shares representing over 5%, 10%, 15%, 20%, 25%, 33.33%, 50%, 66.66%, 90% or 95% of the capital stock or voting rights must, within five stock market trading days of crossing the threshold, inform the company and the French Stock Market regulator (the AMF) of the total number of shares or voting rights held. Notification must also be given when the number of shares or voting rights falls below one of these thresholds.

In the event that disclosure is not made as defined above, the voting rights attached to the shares exceeding the threshold and that ought to have been declared are suspended until such time as the situation has been corrected and for a period of two years after the date of due notification.

Furthermore, the commercial court for the area in which the registered office is located may, at the request of the company’s chairman, a shareholder or the AMF, suspend for a period of no more than five years all or part of the voting rights of the shareholder who failed to disclose the crossing of a threshold.

Independently of civil penalties, any person, chairman, director, member of the board, chief executive or other senior officer of a legal entity bound by the provisions of Article L.223-7 of the Commercial Code who fails to observe those provisions may be fined €18,000.

Lastly, any person who acquires over 10% or 20% of a company’s capital stock or voting rights must, within 10 stock market trading days of crossing the threshold, declare the objectives he intends pursing for the following 12 months to the company and the AMF.

Statutory provisions

Article 10b of VINCI’s corporate statutes sets out an additional requirement: any person or entity, acting alone or jointly with others, who comes to hold or ceases to hold a proportion of the capital stock, voting rights or securities giving future access to the company’s capital stock equal to or greater than 1%, or a multiple thereof, including a multiple exceeding the notification thresholds defined by legislative and regulatory provisions, must inform the company within five stock market trading days of the date of crossing one of these thresholds or, when a Shareholders Meeting has been convened, no later than midnight (Paris time) of the third working day before the meeting, of the total number of shares, voting rights or securities giving future access to the company’s capital stock held directly or indirectly on its own account or jointly with others.

Failure to meet this obligation, and at the specific request of one or several shareholders holding at least 5% of the company’s capital stock, the voting rights attached to the shares exceeding the threshold and that ought to have been declared shall be suspended for all shareholders meetings held within two years of the date of due notification.